Here we are, a week past the election, and it’s looking like the year 2000 all over again, with a long, drawn-out process until there is final certification of this election. Back then, it took a full five weeks for all of the legal process to play out. Hopefully, by the end of this process, we can all accept the final outcome, and move together as a country.

At least now we have social media to help us with all the healing! (That was a joke, in case you weren’t clear.)

But really — this is a great time to steer clear of social media and keep your mind clear for what YOU are called to do, both vocationally and in your personal life.

No matter what happens in Congress and in the White House, the most important factor for how well you might move forward is entirely up to the decisions that YOU make. Nobody else can do what you do.

For example, YOUR financial situation is far more likely to be impacted by one simple factor: whether you make decisions with the future in mind … or not.

And one of those future events will be that this donkey of a year, 2020, WILL END.

And with it will end any opportunity you might have to make tax-related changes to your financial situation. Most tax planning strategies completely dry up after 12/31, so take a look at these and let’s talk if you think you could use some help…

We’re right here: 858-549-9666

Darryl A. Hale, EA, MBA, MST’s Seven End of Year Tax Planning Strategies

“When you know better, you do better.” -Maya Angelou

Ah, November. Cool weather, Thanksgiving, football. Even though 2020 still seems to be chugging along in all of its particular form of glory, we can at least get productive and distract ourselves from the political war games by making a positive impact on our financial world.

Here are some tax planning strategies to consider as you do:

1) Look ahead to 2021. By that, I mean: what will your income potentially look like in 2021? For some, ANY income after a very rough 2020 would be welcome. But once you have that landed … should I accelerate possible 2021 income into 2020 for tax reasons? Because the best of both tax worlds is to reduce your taxes in both years.

So take a look to see what you think your income will be looking like by the end of this year (including any investment year-end payouts, gig work, gambling winnings, etc. ) and what you expect it to be in 2021 (more, less or about the same). Next, check out the tax brackets and evaluate whether you need to defer current taxable income or accelerate write-offs into 2021 or vice versa. Keep more take-home through proper planning!

2) Adjust your withholding. By now, you should be able to look at what your income will most likely be by year-end, and you can keep more of it in your pocket instead of “loaning” it to Uncle Sam via withholding, and getting it back via refund. Conversely, you can make sure you don’t get slapped by a bill. (Remember, unemployment compensation is usually taxable.)

3) If you have one, spend down your FSA. These are usually offered through big San Diego organizations and companies, and can be a very nice benefit. They set aside pre-tax dollars that you can spend on medical expenses that aren’t covered by your insurance. But they have one big drawback: you have to use up all of it by the end of the benefits year, which is Dec. 31 for most companies, or you’ll lose them.

4) Give to charity. Did you know the CARES Act enables you to deduct up to $300 in donations, even if you take the standard deduction? I’ll have more to say about this in future weeks, but it’s a great idea to get in this habit, and hopefully you are able to give much more.

5) If you have the means, give tax-favored gifts to your family. This really is for those who are in retirement, and who have socked away a fair amount. You can give $15,000 per person in 2020 and in 2021 each tax year without paying gift tax or tapping your lifetime estate and gift tax exemption. Your spouse can do the same, even to the same person. But again … use this clause or lose it forever after 12/31.

6) Max out any workplace retirement accounts. Like 401(k)’s — that deadline is 12/31. Regular IRA and Roth IRA’s can be added to even up to 4/15/21.

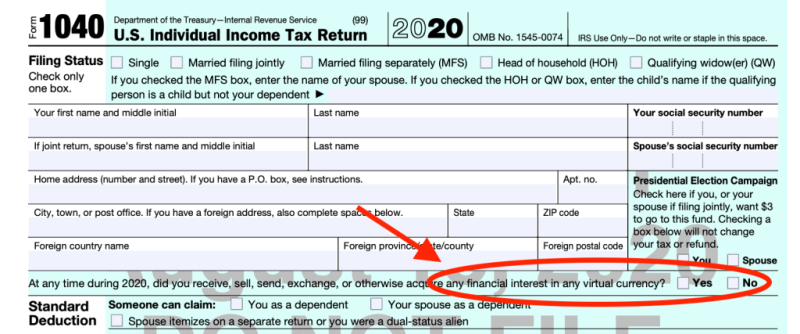

7) Collect any virtual currency documentation. New this year, the IRS is asking people on PAGE ONE of the 1040 whether you had any such transactions, etc.

Yes, that stuff can be more secure and a form of investment … but it ain’t tax free.

For all of these tax planning strategies, we’re here to help. 858-549-9666

To your (extended) San Diego family’s lasting financial and emotional peace ~Contact.FirstName~…

Warmly,

Darryl A. Hale, EA, MBA, MST

“CRISIS Action Plan” for my San Diego tax clients and friends — which is still relevant today:

1) Don’t marinate in other people’s panic. Be mindful of your social media consumption.

2) Continue to stay financially and logistically prepared for worsening situations.

3) Make sure you have some ready, liquid assets, if you are able. (I.e., cash in the bank, and in hand.)

4) Set aside plans for any big spending until the dust settles — but especially look out for your small business owner friends and vendors.